Financial 4.0 is a FREE resource that provides financial education, resources, and tools to help you dream BIG and achieve your goals. Explore blogs, podcasts, and more — all created by certified financial educators. This is your hub for financial learning.

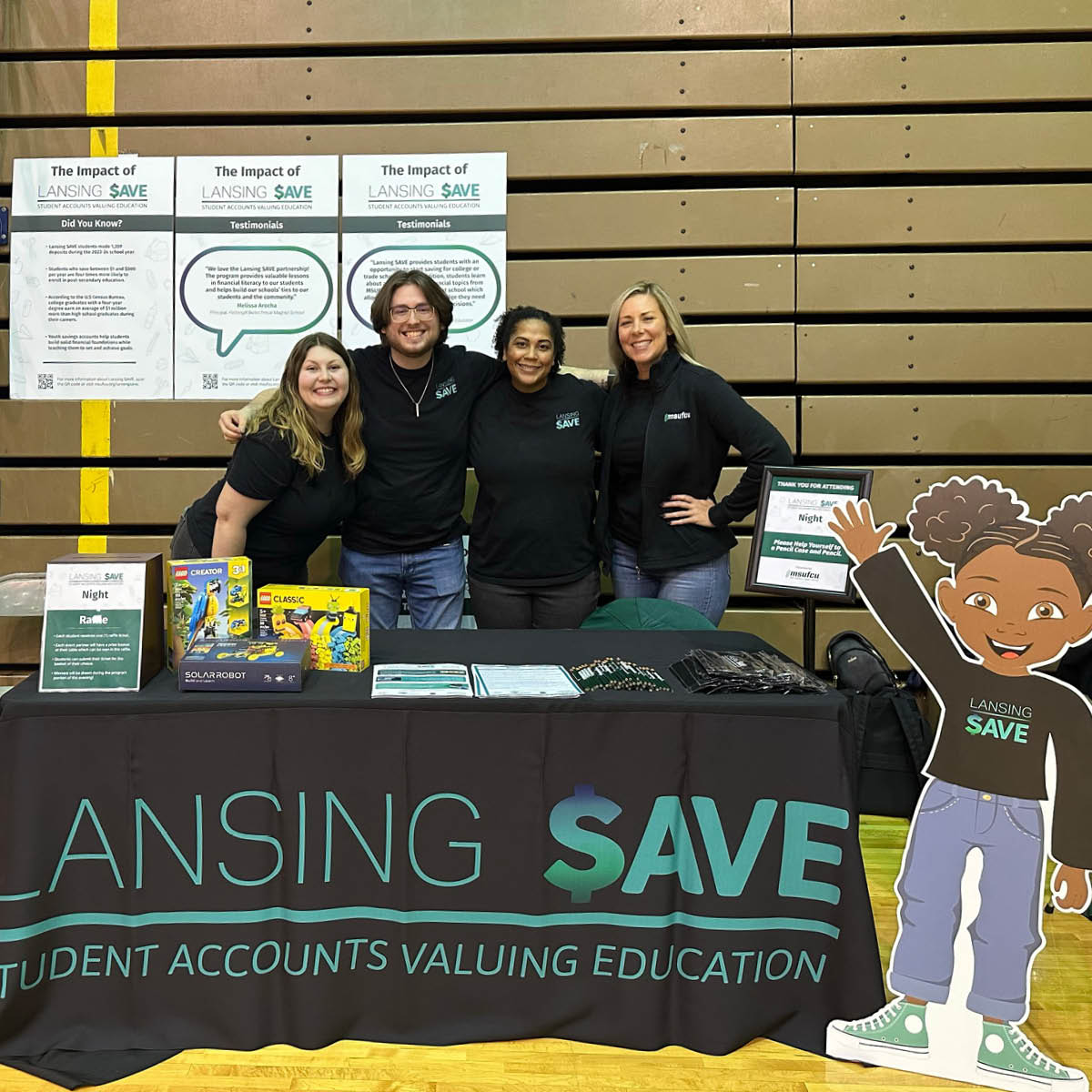

Financial 4.0 is active on the campus of

Michigan State University and

Oakland University, hosting financial education workshops, events, and more.